Hsn Code For Organic Food Products

Hsn code for organic food products. PLU codes are four digit numbers that identify different types of produce. Jaggery of all types including Cane Jaggery gur and Palmyra Jaggery. Other Organic Compounds Other Organic Compounds.

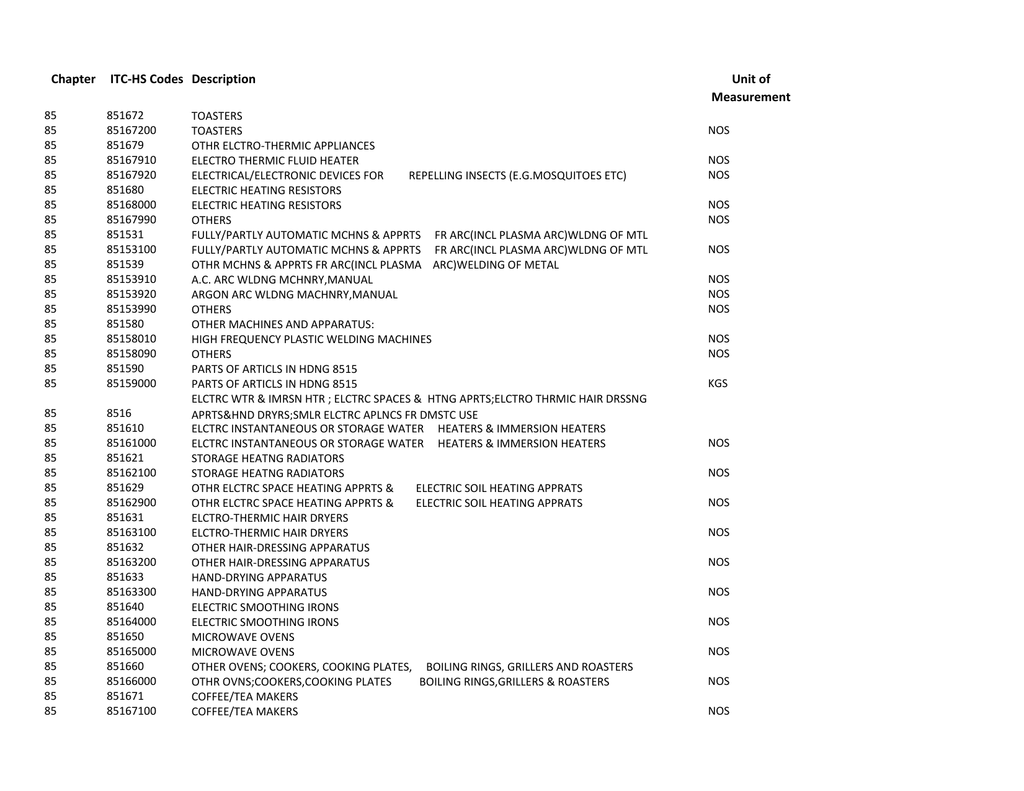

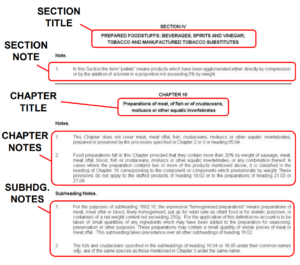

Soap Organic Surface- Active Agents Washing Preparations Lubricating Preparations Artificial Waxes Prepared Waxes Polishing or Scouring Preparations Candles and Similar Articles Modelling Pastes Dental Waxes and Dental Preparatio. These codes help exporters and importer all over world to know product classification code named differently in each country like Schedule B ITC HS HTS Tariff Code etc. Here you can search HS Code of all products we have curated list of available HS code with GST website.

Description of Goods. FLORICULTURE 06011000 Bulbs Tubers Tuberous Roots Corms Crowns Rhizomes Dormant 06012010 Bulbs Horticultural 06012021 Chicory Plants 06012022 Chicory Roots 06012090 Other BlbsTubrsTubrus Roots Etc. FLORICULTURE SEEDS Subhead.

Hs Code Description No of Shipments. The number 9 prefix added to a PLU signifies that an item is organic. This is a list of multi-purpose international product numbers developed and maintained by the World Customs Organization.

Search by both product name or HS Code with our easy to use HSN Code finder. For example 94011 is the code for an organic yellow banana. In India the HSN code is a six-digit code that is used to classify products for the customs.

Dried - Organic 200110200102 Pickles cucumbers - Organic 200110200202. In above box you need to type discription of productservice or HS Code and a list of all products with codes and tax rates will be displayed. No Comments on List of HSN code for Other Organic Compounds 29420011.

Its a sequence of numbers given for every possible product. Cefadroxil And Its Salts.

Jaggery of all types including Cane Jaggery gur and Palmyra Jaggery.

The number 9 prefix added to a PLU signifies that an item is organic. Organic surface-active products and preparations for washing the skin in the form of liquid or cream and put up on retail sale whether or not containing soap paper wadding felt and nonwovens impregnated coated or covered with soap or detergent falls under GST HSN code number 340130. Search for your products HSN Code or ITC-HS Code along with its GST Rate. Beet sugar cane sugar khandsari sugar deleted wef. HSN is a six-digit code that classifies more than 5000 products arranged in a legal and logical structure. GST Rate and HSN Code Chapter 34. In India the HSN code is a six-digit code that is used to classify products for the customs. Soap Organic Surface- Active Agents Washing Preparations Lubricating Preparations Artificial Waxes Prepared Waxes Polishing or Scouring Preparations Candles and Similar Articles Modelling Pastes Dental Waxes and Dental Preparatio. Cefadroxil And Its Salts Ibuprofane Nifedipine Ranitidine Danes Salt Of D- Phenyl Glycine D- Para Hydroxy Danes Salts.

HSOGD extension codes Commodity description. 3808 Insecticides Rodenticides Fungicides Herbicides Anti-Sprouting Products And Plant-Growth Regulators Disinfectants. Find GST HSN Codes with Tax Rates. HARMONISED PRODUCT CODE LIST HARMONISED PRODUCT CODE LIST HSCODE PRODUCT DESCRIPTION Head. FLORICULTURE 06011000 Bulbs Tubers Tuberous Roots Corms Crowns Rhizomes Dormant 06012010 Bulbs Horticultural 06012021 Chicory Plants 06012022 Chicory Roots 06012090 Other BlbsTubrsTubrus Roots Etc. Other Organic Compounds Other Organic Compounds. For example 4011 is the code for a standard yellow banana.

_2.jpg)

Post a Comment for "Hsn Code For Organic Food Products"