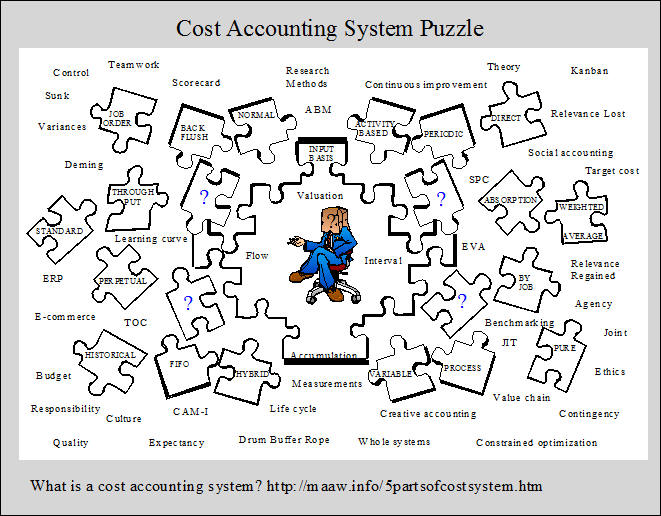

Companies That Use A Process-cost Accounting System Would

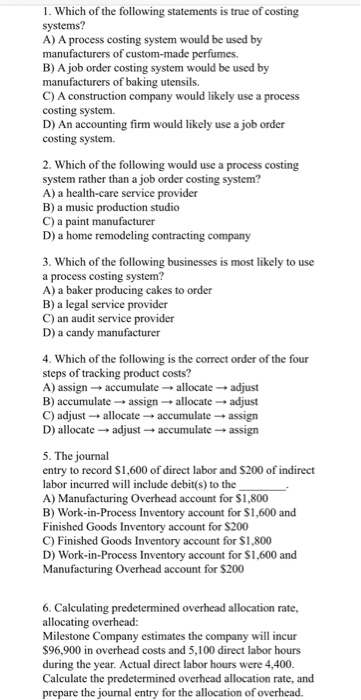

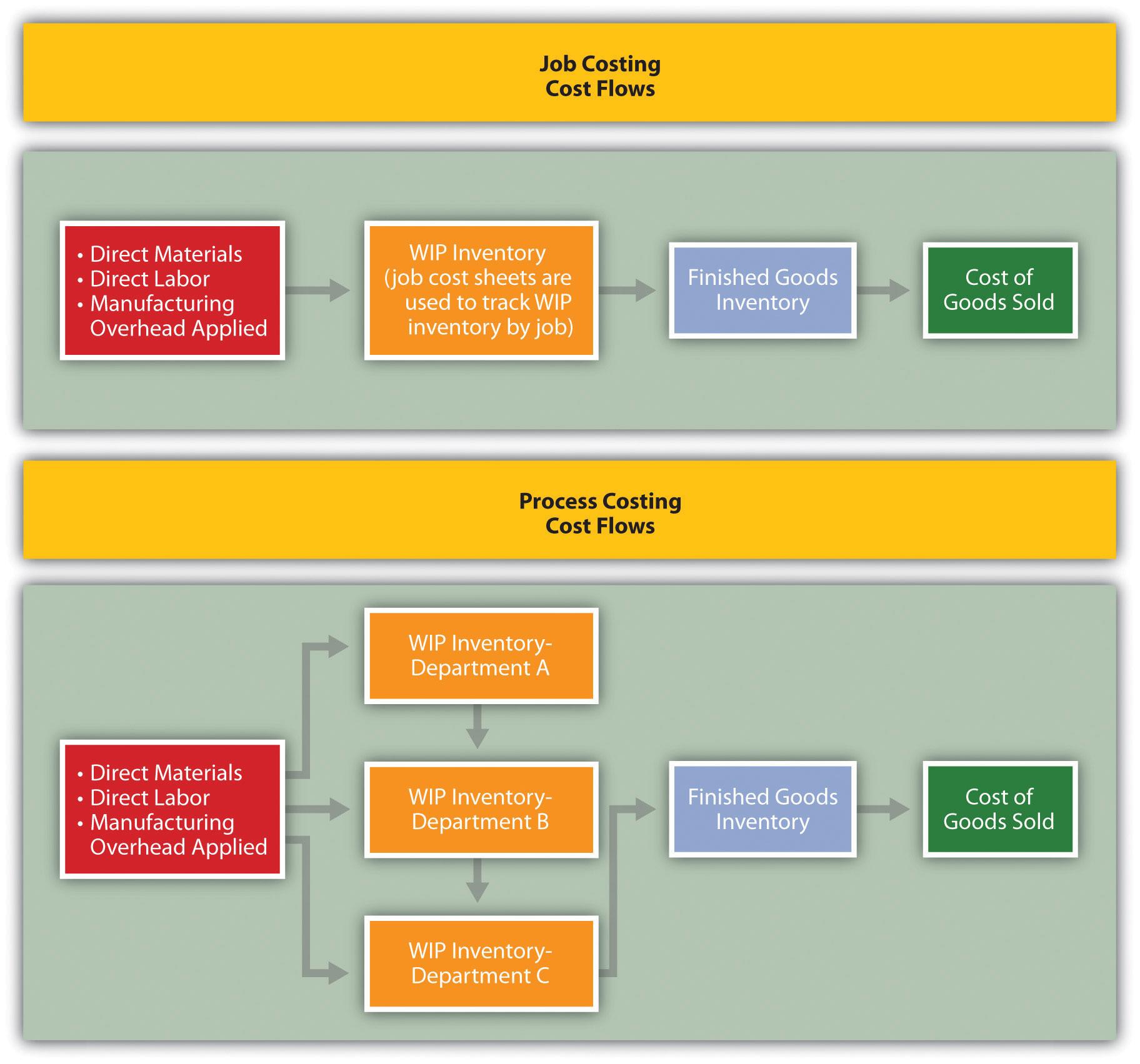

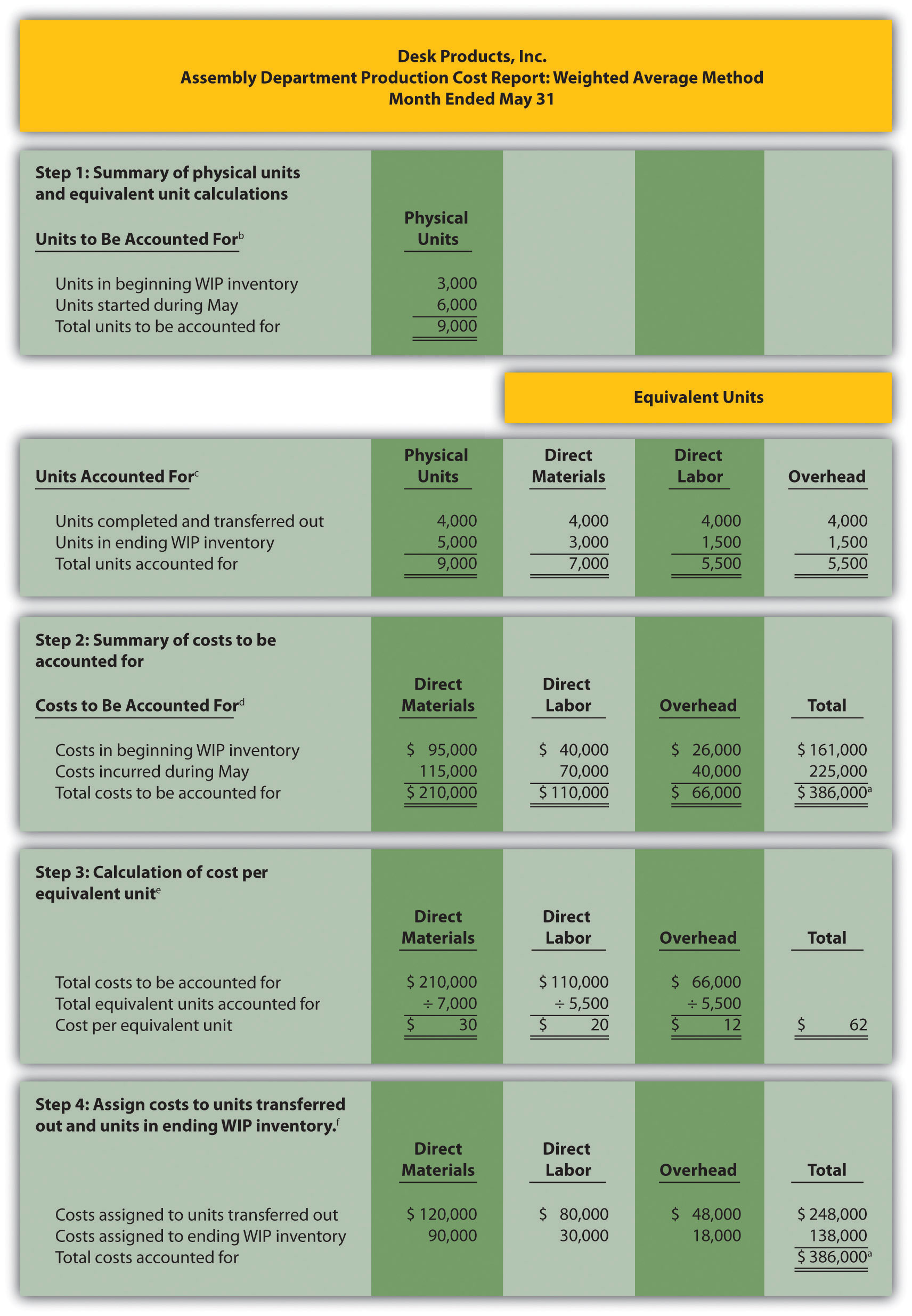

Companies that use a process-cost accounting system would. D Products and average costs. Then assign the costs to units of output as they move through the departments. Establish a separate Finished-Goods Inventory account for each manufacturing department.

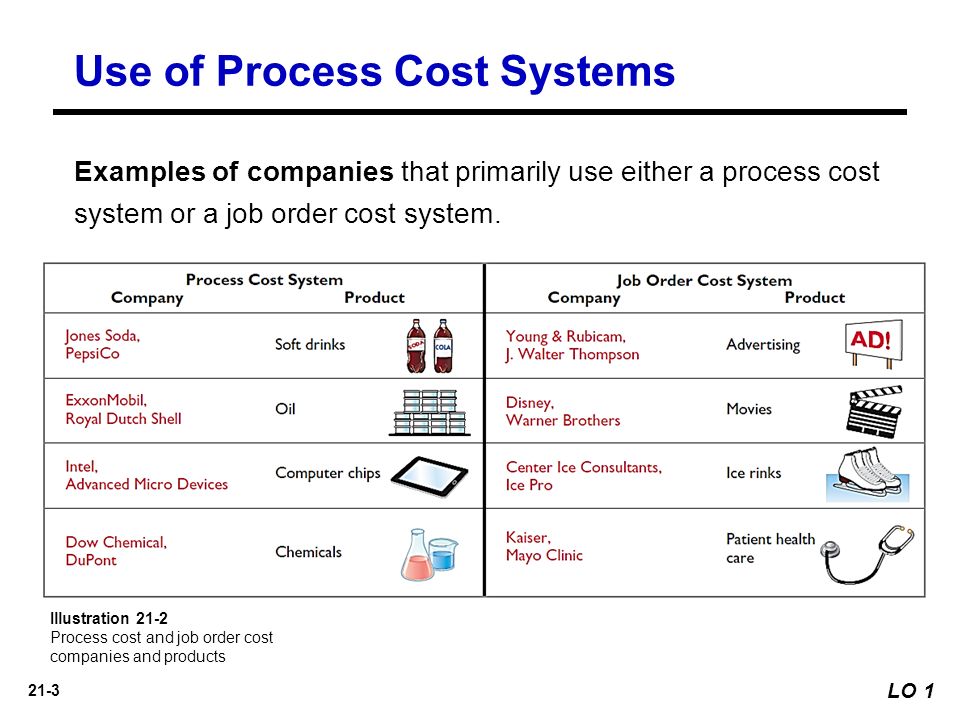

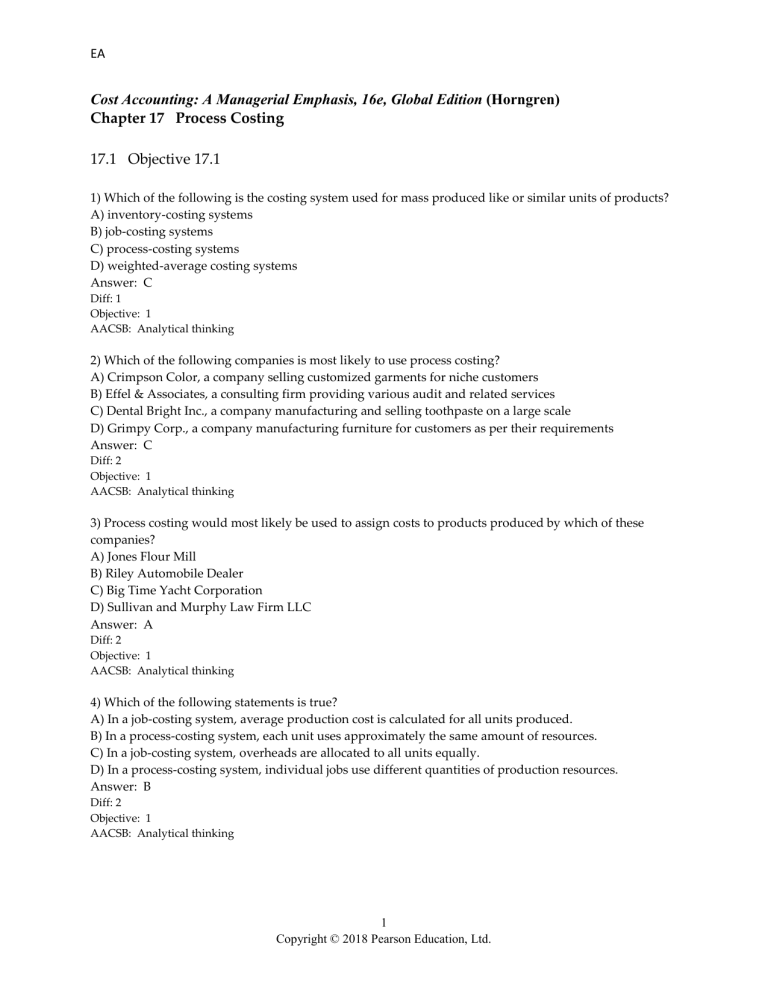

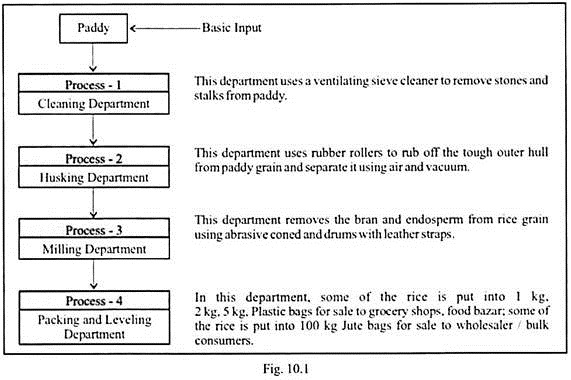

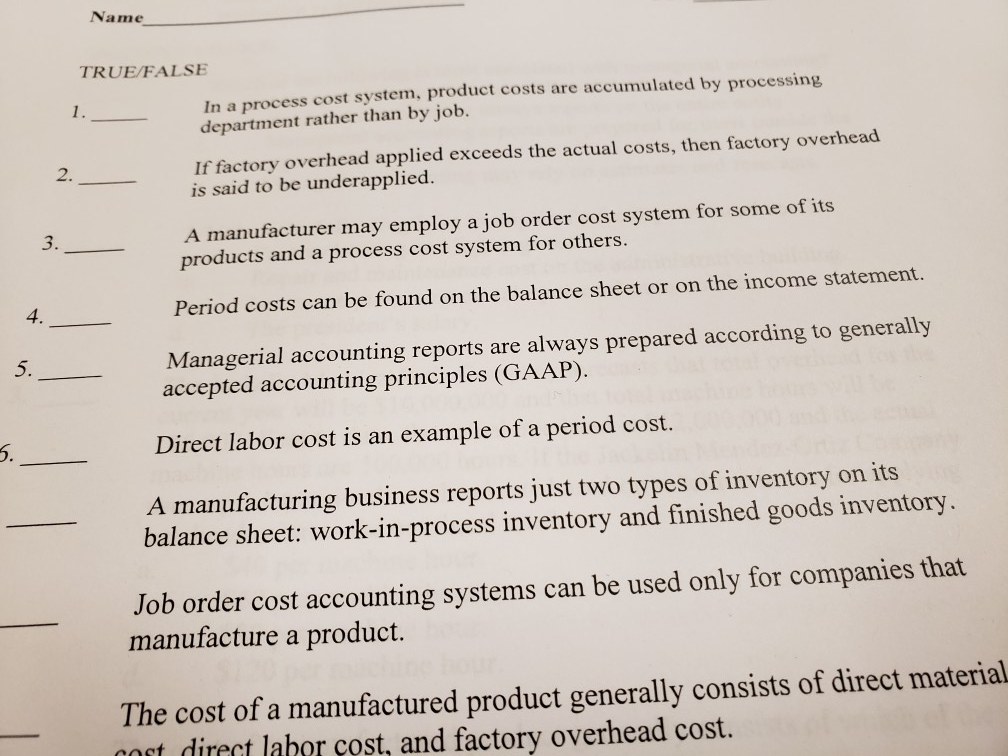

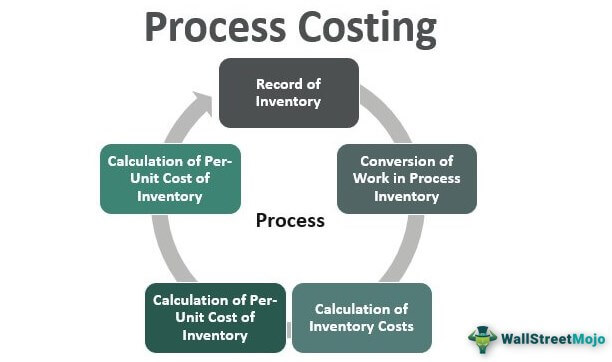

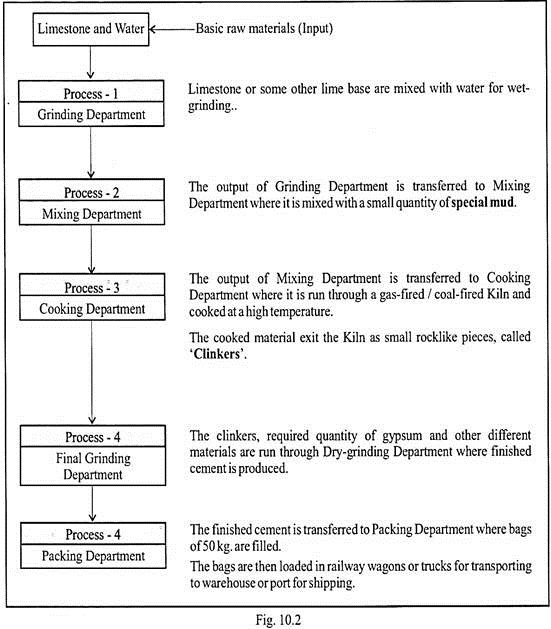

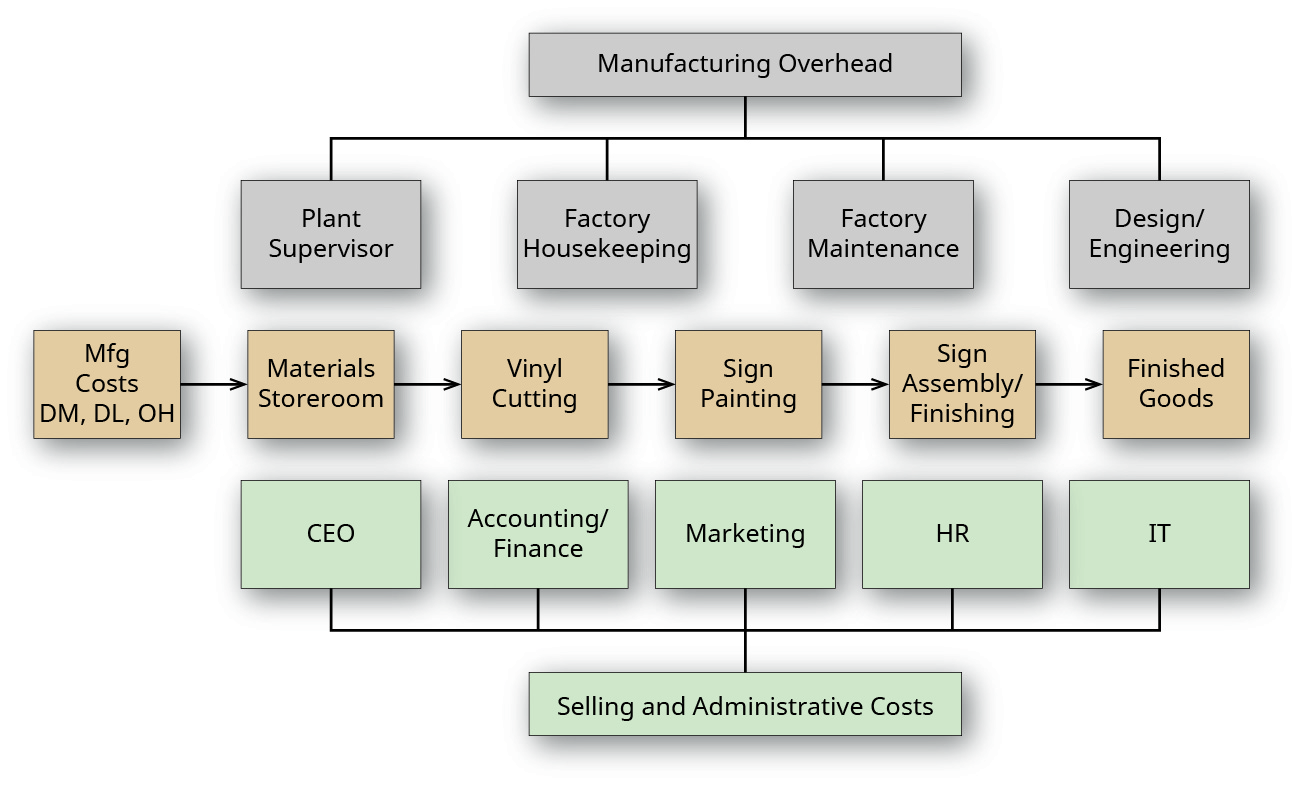

E Large volume operations involving standardized products. Process Costing and Hybrid Product-Costing Systems 1. The first department in the process is the casting department where the widgets are initially created.

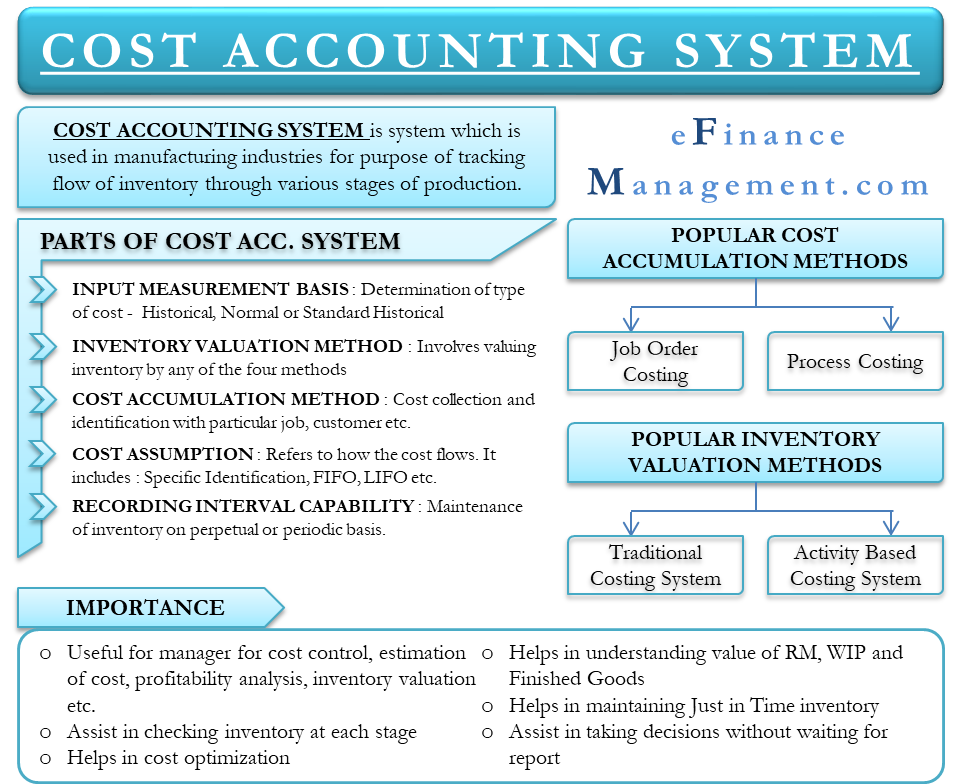

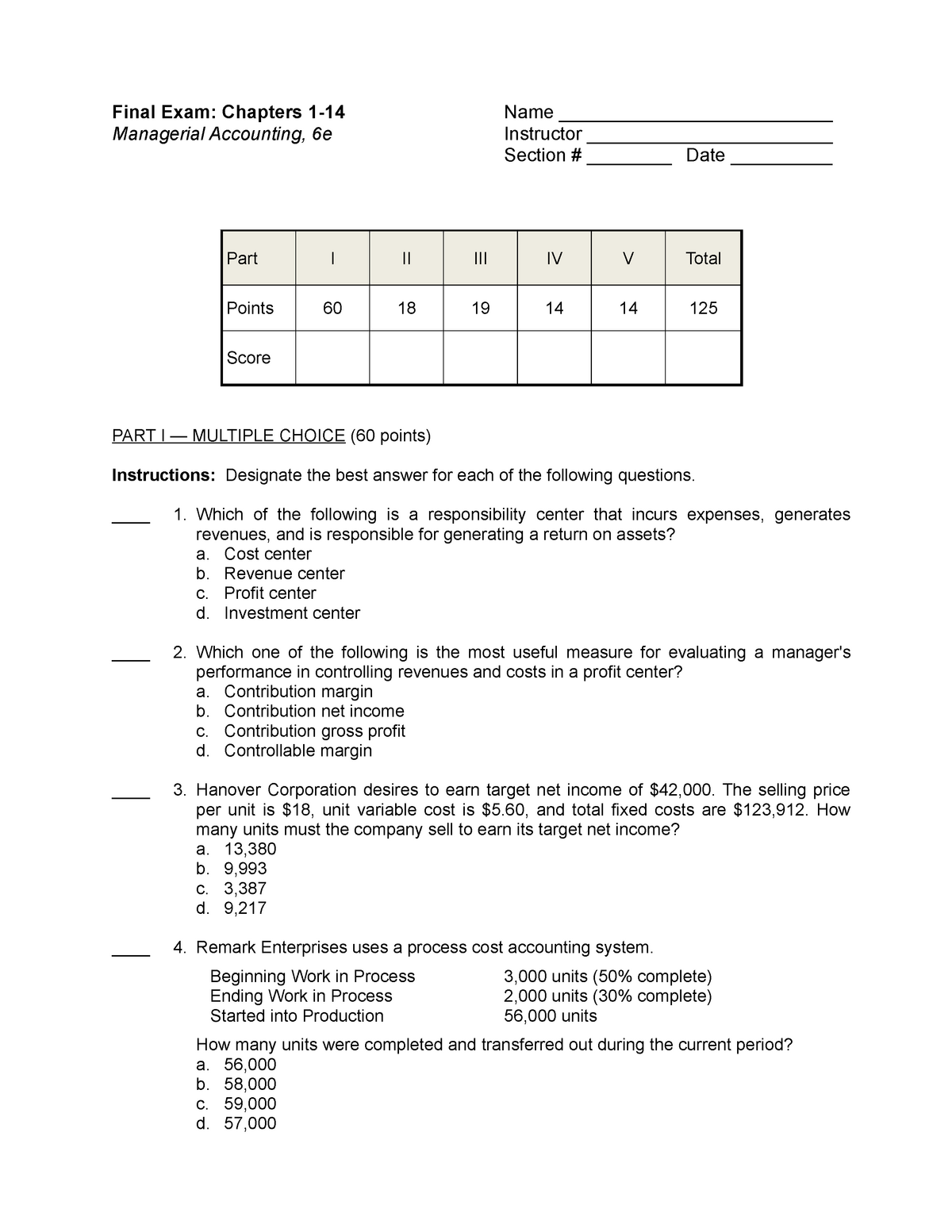

Establish a separate Finished-Goods. Process costing system A document that shows the direct materials direct labor and manufacturing overhead costs for an individual job. Production cost errors often represent a significant disadvantage for cost accounting systems.

Start Your Free Trial Now. Companies that use a process-cost accounting system would. Companies that use a process-cost accounting system would.

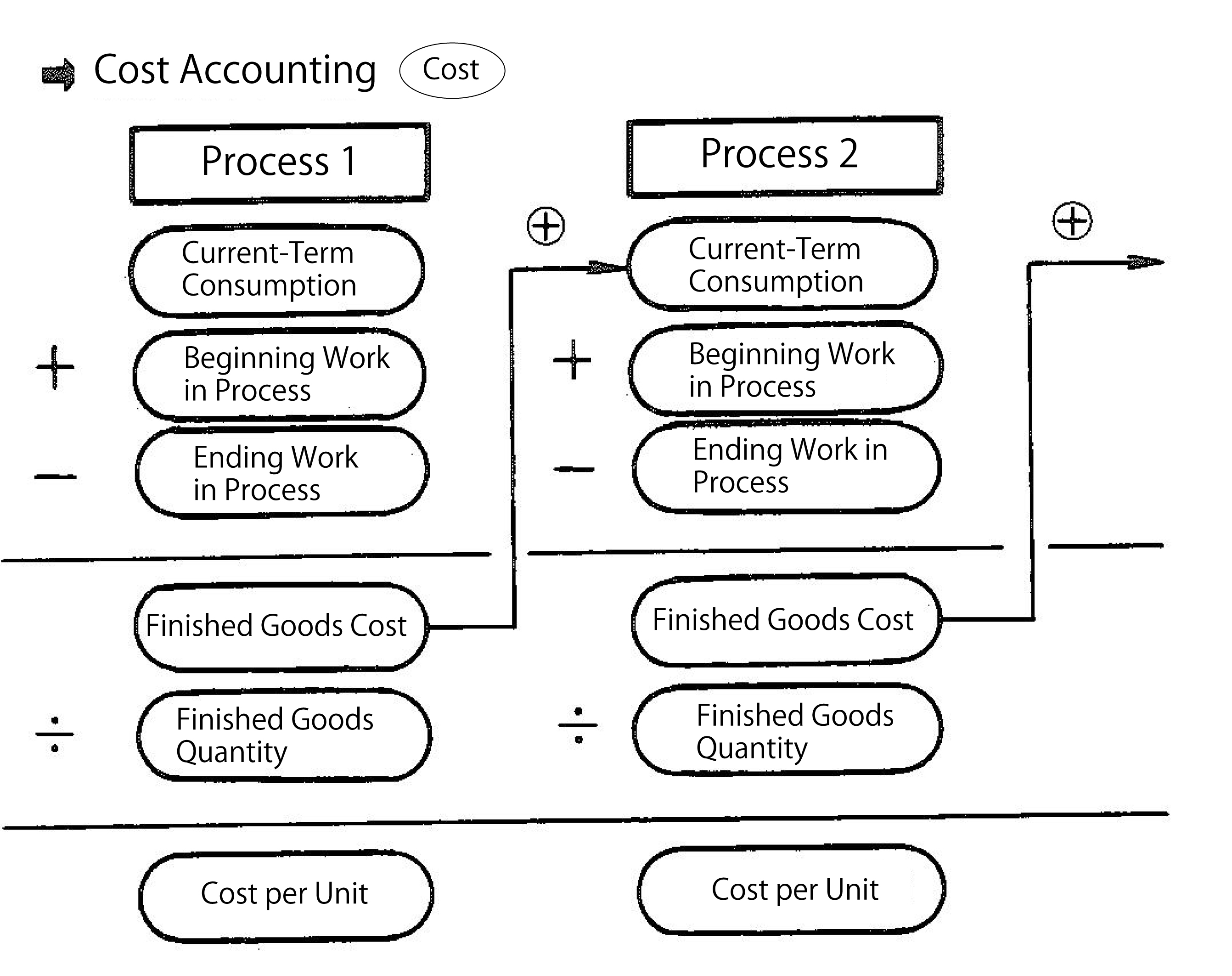

C Continually updating costs of materials work in process and finished goods inventories. Establish a separate Work-in-Process Inventory account for each processing department. Process costing systems allocate expenses to products by.

Companies that use a process-cost accounting system would. Costs can include direct materials production labor and manufacturing overhead. Companies that use a process-cost accounting system would.

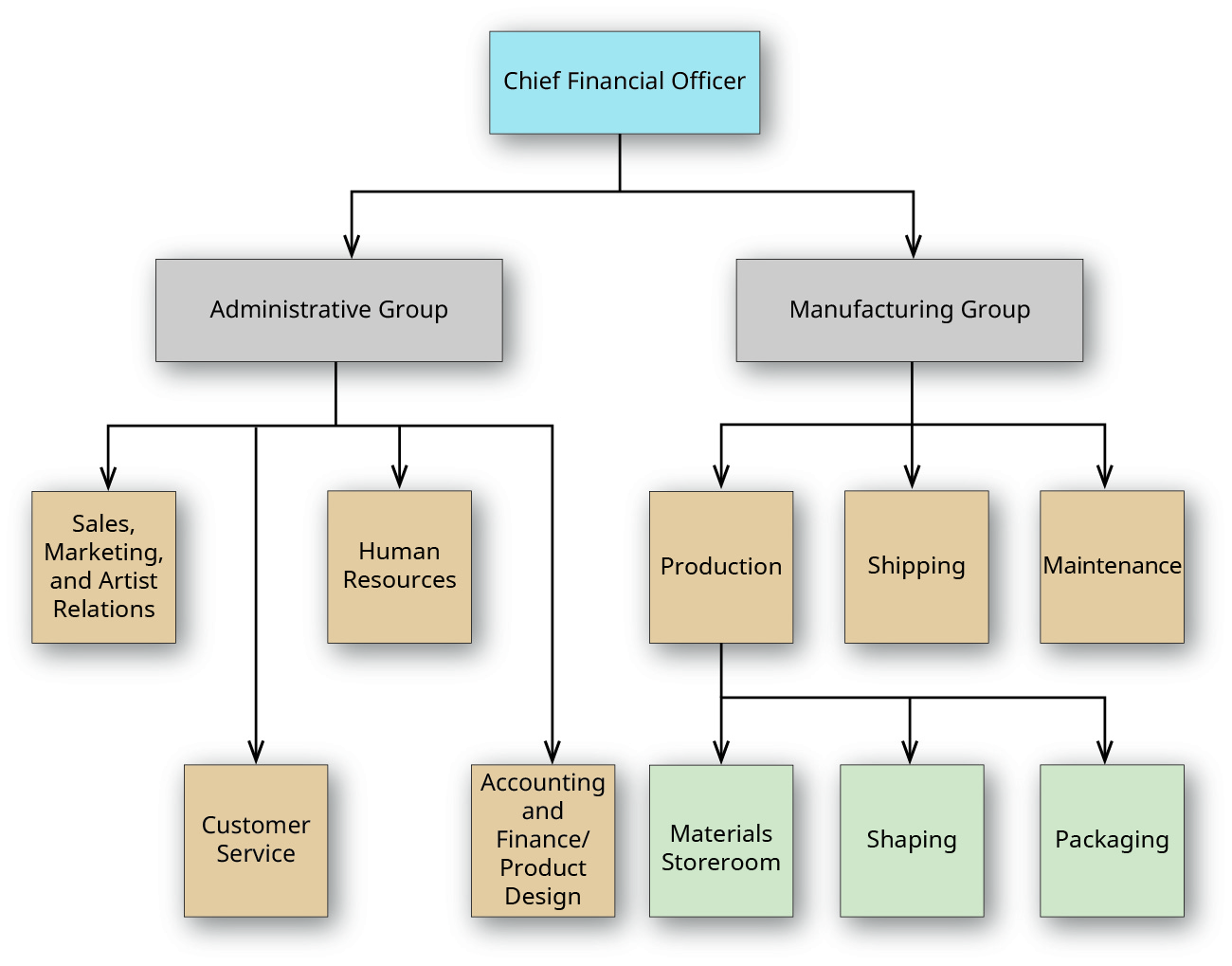

B Calculate the average cost per equivalent unit for direct labor round to the nearest cent. Companies that use a process-cost accounting system would establish a separate Work-in-Process Inventory account for each manufacturing department.

Start Your Free Trial Now.

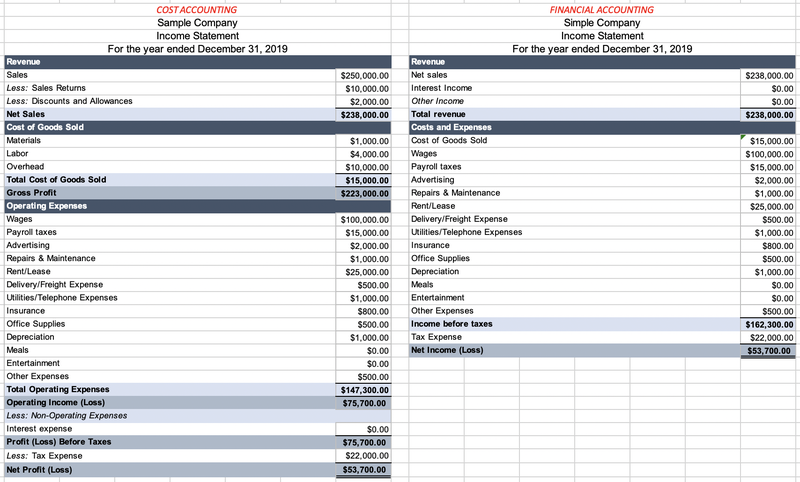

Charge goods produced with actual overhead amounts rather than applied overhead amounts. Costs are assigned first to production departments. A Periodic inventory counts. A process costing system accumulates costs and assigns them at the end of an accounting period. Establish a separate Finished-Goods. The classic example of a process costing environment is a petroleum refinery where it is impossible to track the cost of a specific unit of oil as it moves through the refinery. Companies that use a process-cost accounting system would. Establish a separate Finished-Goods Inventory account for each manufacturing department. Ensure Accuracy And Prove Compliance With FreshBooksMade For Small Businesses Like Yours.

Pass completed production directly. Ensure Accuracy And Prove Compliance With FreshBooksMade For Small Businesses Like Yours. Production cost errors often represent a significant disadvantage for cost accounting systems. Companies that use a process-cost accounting system would. At a very simplified level the process is. Establish a separate Work-in-Process Inventory account for each job order. Example of Process Cost Accounting.

Post a Comment for "Companies That Use A Process-cost Accounting System Would"